Georgetown, Del., Aug. 11, 2025: Sussex County is showing the math when it comes to the calculation of tax bills arriving soon following the recent property reassessment.

As County tax bills for the 2026 fiscal year begin making their way to property owners in the coming days, County officials recently provided an update on the yearslong property reassessment project.

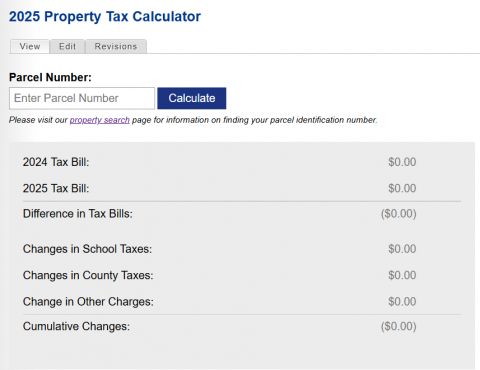

To assist the public, the County has designed a new tax calculator – building off an earlier iteration that worked on estimates only – that is parcel-specific and is powered with real numbers, including each property’s actual assessed value and various property tax rates since set by the County and the local, independent school districts.

County Finance Director Gina A. Jennings said the County wants to give the public as much information as possible so property owners have a clear understanding of why their tax bills may be higher, or lower in some cases, from the previous year.

“There are multiple reasons beyond just the assessment that could change bills, so we wanted to create a calculator that showed the difference between tax bills last year versus this year,” Ms. Jennings said. “In the interest of transparency, and to help the public understand what’s changed, we believe the new calculator will be a handy tool in providing a side-by-side comparison of the two different tax years.”

The calculator can be viewed at www.sussexcountyde.gov/2025-property-tax-calculator. Sussex County property tax bills are issued in August, with payment due by Sept. 30.

###